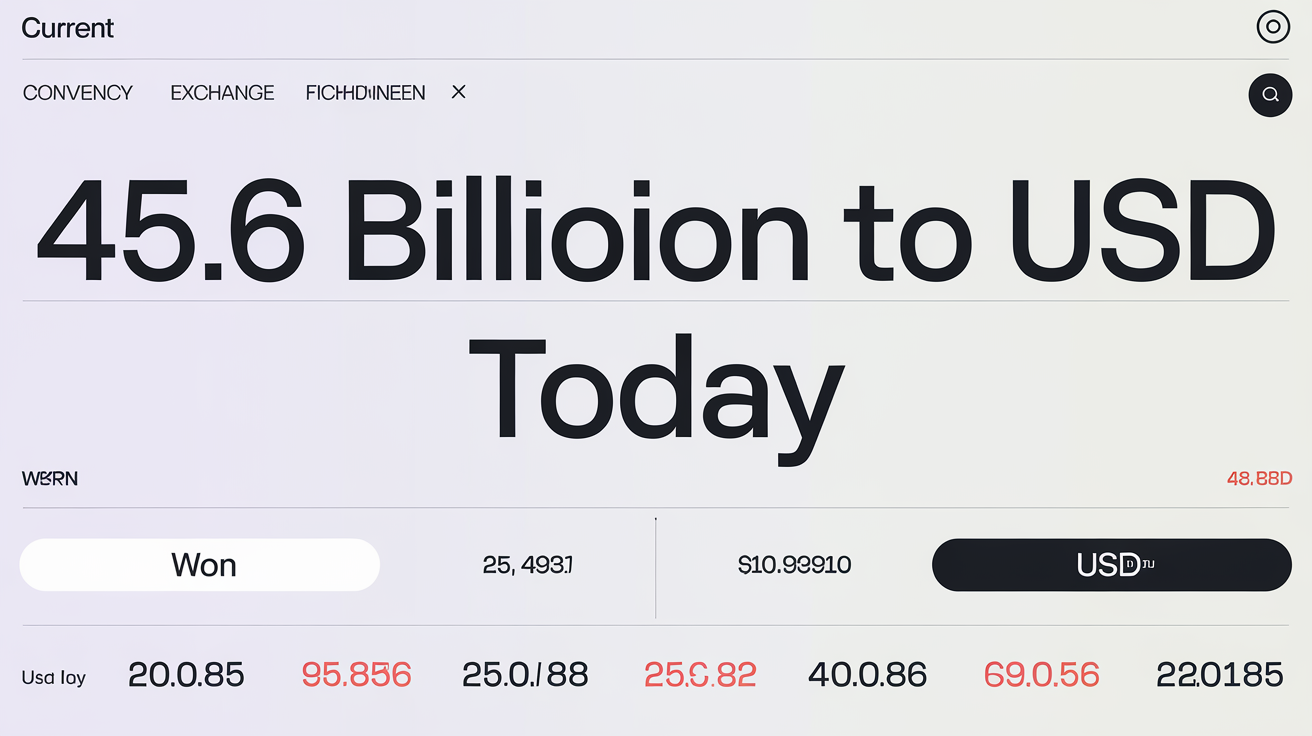

Introduction 45.6 Billion Won to USD

Currency exchange plays a vital role in global economics, investment decisions, and international trade. A frequent point of interest for investors and the general public alike is understanding large foreign currency figures in local terms. One such figure that has recently garnered attention is 45.6 Billion Won to USDSouth Korean Won (KRW). When trying to understand the significance of this amount in global terms, it’s important to convert it into a more widely used currency like the United States Dollar (USD).

This article dives deep into what 45.6 billion KRW translates to in USD, how currency conversion works, what factors influence exchange rates, and why such conversions are important in economic discussions.

The Basic Conversion: 45.6 Billion KRW to USD

To begin with, we must understand the current exchange rate between the 45.6 Billion Won to USD South Korean Won (KRW) and the US Dollar (USD). Exchange rates are dynamic and fluctuate based on market conditions. As of June 2025, the average exchange rate is approximately:

1 USD ≈ 1,380 KRW

To calculate the value of 45.6 billion KRW in USD, we use the following formula:

USD = KRW / Exchange Rate

So,

USD = 45,600,000,000 / 1,380 ≈ 33,043,478

Therefore, 45.6 billion KRW is approximately equal to 33 million USD, depending on the prevailing exchange rate.

Currency Exchange Rates and Their Significance

How Are Exchange Rates Determined?

Exchange rates between two currencies are determined in the foreign exchange market (Forex). The Forex market is the largest and most liquid financial market in the world. The rate between two currencies like KRW and 45.6 Billion Won to USD is influenced by several factors:

-

Interest rates set by central banks

-

Inflation levels

-

Trade balances

-

Political stability and economic performance

-

Market speculation

In the case of South Korea and the US, macroeconomic policies by the Bank of Korea and the Federal Reserve influence how the KRW stands against the 45.6 Billion Won to USD.

Why Do Exchange Rates Fluctuate?

45.6 Billion Won to USD Currency values fluctuate due to supply and demand dynamics. For example, if international investors see strong growth potential in the Korean economy, they might buy KRW, increasing its value. Conversely, global uncertainty or geopolitical issues might lower KRW demand, making the USD stronger in comparison.

45.6 Billion Won to USD Currency values fluctuate due to supply and demand dynamics. For example, if international investors see strong growth potential in the Korean economy, they might buy KRW, increasing its value. Conversely, global uncertainty or geopolitical issues might lower KRW demand, making the USD stronger in comparison.

Real-World Context: What Does 45.6 Billion KRW Represent?

To grasp the real-world significance of 45.6 Billion Won to USD it helps to understand how this amount is used in South Korea. In USD terms, 33 million dollars could be involved in:

-

A medium-sized corporate acquisition

-

A government subsidy or budget allocation

-

Entertainment or film industry investments

-

A sports contract or event funding

-

Major real estate developments or infrastructure projects

For instance, South Korea’s entertainment industry regularly handles budgets in the billions of won. A blockbuster K-Drama production might cost anywhere from 10 to 50 billion KRW. Similarly, technology companies or startups may raise tens of billions of won in a funding round.

Case Example: Korean Investment in the US or Vice Versa

Currency conversions such as 45.6 billion won to USD often appear in international business news. For example:

-

A South Korean conglomerate like Samsung or LG may announce a $33 million investment in a U.S. tech startup.

-

A U.S. hedge fund might purchase Korean real estate or bonds valued at 45.6 billion KRW.

-

The Korean government may allocate 45.6 billion KRW for international diplomacy or humanitarian aid abroad, prompting conversion to USD.

Understanding the USD equivalent helps both local and international readers understand the magnitude and relevance of these financial figures.

Impact of Conversion on Business and Trade

International Contracts and Settlements

When businesses operate across borders, they often have to sign contracts that specify payment in a stable and globally accepted currency—commonly the USD. If a South Korean firm signs a $33 million contract with a U.S. vendor, they must prepare to pay 45.6 Billion Won to USD KRW or more, depending on the exchange rate at the time of payment.

Investment Decisions

Investors—whether retail or institutional—use currency conversion to evaluate opportunities. A U.S. investor looking at a Korean stock must evaluate whether 45.6 billion KRW in revenue or valuation justifies investment, especially when converted to their home currency.

Exchange Rate Risks and Hedging

Currency fluctuations can create risk for companies and governments. If the KRW weakens significantly after a contract is signed, a Korean company may have to spend more won to meet its USD obligations. This is known as exchange rate risk.

To manage this, many firms engage in hedging through financial instruments such as:

-

Forward contracts

-

Options

-

Currency swaps

Such tools help lock in favorable exchange rates and reduce uncertainty in large-value transactions.

Role of Central Banks

The Bank of Korea (BOK)

The BOK monitors foreign exchange markets and may intervene to stabilize the KRW. This might include buying or selling USD in the open market to influence the KRW’s value.

The Federal Reserve (FED)

The U.S. Fed’s interest rate policies also have global implications. When U.S. interest rates rise, the USD becomes more attractive to investors, often causing emerging market currencies like the KRW to depreciate.

Tools for Real-Time Currency Conversion

While this article provides a static estimate of 45.6 Billion Won to USD KRW being around 33 million USD, exchange rates change daily—sometimes hourly. Tools such as:

-

XE.com

-

OANDA

-

Google Currency Converter

-

Yahoo Finance

…provide real-time conversion and historical trends.

For businesses, banks also offer custom conversion services with live forex rates, which may differ from the market average due to transaction fees or conversion margins.

Conclusion: Why This Conversion Matters

The conversion of 45.6 Billion Won to USD KRW to USD—roughly 33 million USD—is more than just a mathematical exercise. It holds real value for international businesses, investors, policymakers, and analysts. Whether it is used in trade, investment, aid, entertainment, or tech, knowing the USD value allows for:

-

Better comparison of financial scales

-

Informed decision-making

-

Improved transparency in contracts

-

Risk management in global markets

As globalization continues to deepen economic ties between countries like South Korea and the United States, understanding such conversions becomes increasingly essential.

You Many Also Read: myfastbroker.com